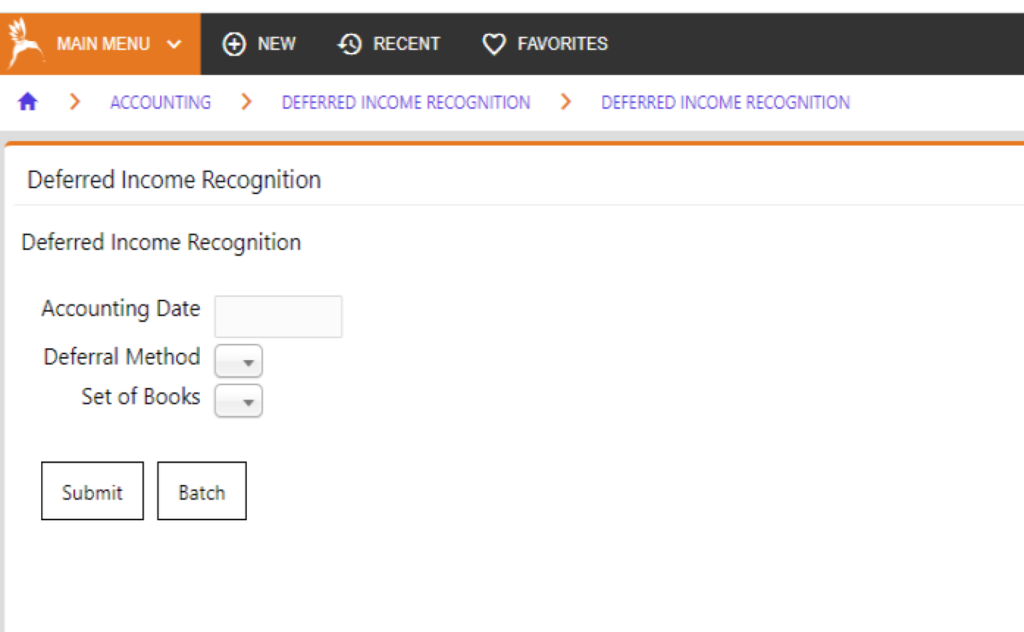

- Accounting (Tab) –> Deferred Income Recognition (Ribbon) –> Deferred Income Recognition (Action)

- Enter the Accounting date (usually the last day of the month) and the deferral method. Note – deferral method is defined under the setup accounting information link for the subgroup; for membership, it is usually set to monthly.

Click submit or batch to run the program.

Note – if the process will take some time to complete, it is recommended the batch option be used. The program will create a cash receipt batch that moves money from the deferred accounts to the actual accounts.

Computation of Recognized Amount

The deferred income recognition process will recognize the portion of revenue that the client is entitled to recognize, based on the amount of service that has been delivered.

Formula:

Amount Actually Recognized = Amount Entitled to Recognize – Amount Already Recognized

where

Percentage To Recognize = Months Between (Start of Order vs Income Recognition Date ) / Months Between (Start of Order and End of Order )

Amount Entitled To Recognize = Percentage to Recognize X Amount Deferred

Amount Deferred is determined by GL split in the pricing, and may be all, or only part, of the amount of the item

How Does Each Subsystem Set the Service Dates, to Affect the Percentage to Recognize?

The accounting date you enter when running the deferred income recognition process will be considered the accrual recognition date. All prorated recognition will be computed based on that date, relative to the dates of service.

- Membership – Dates of service are the start and end dates of the membership order (i.e. join date to expire date for first year membership, order start to end date for each subsequent renewal)

- Subscriptions – Dates of service relative to the start and end dates of the subscription period

- Donations – Dates of service for recognition purposes are Start and End date of donation year. Note that deferred income recognition for fundraising is rare. Users can manually enter start and end dates, to affect the period over which donations are recognized

- Event Registrations – Dates of service start / end are set to the End Date of the Event, unless you specify other specific dates in setup of the event on the accounting parameters screen. Thus, the event registrations will always behave essentially as a one-time recognition on the end date of the event, regardless of the method configured.

- Advertising – Generally the recognition dates are the dates of the issue in which the ad is inserted

- Order Processing – For Version 5, generally requires additional configuration but sets the start date and end date of the income recognition in the shipping process after the order has shipped. More recent versions of Association Anywhere 6.x exclude Order processing from general deferred income recognition in A/R. Order Entry includes its own more precise income recognition subsystem based on inventory.

- Exhibits – – Dates of service start / end are set to the End Date of the Event, unless you specify other specific dates in setup of the event on the accounting parameters screen.

Methods Supported

When you set up a product such as a membership subgroup, a subscription package, a fund code, a registerable event, or an advertising publication, you can also set up a deferred income method:

Any orders for the product, from that point forward, will be tagged with the income method chosen.

The amount to recognize will follow one of the following contours. The various methods supported are best illustrated showing an order such as a membership or subscription that spans multiple years, although single year orders are much more common in practice. The following illustrations are for a 3-year membership order.

Monthly Method

When the method you set up is MONTHLY, then the system will compute the amount entitled to recognize as the number of months elapsed in equal monthly portions over the period of service. This is most common for membership and subscriptions.

Onetime Recognition

When using the ONETIME recognition method, the system will attempt to recognize the entire deferred amount of the order on the start date of the order. This is most commonly used for order entry / ecommerce purchases, event registrations that are recognized as soon as the event is over, or for one-year memberships that are billed in advance of a calendar or fiscal year and recognized in full at the start of the fiscal year.

Anniversary Recognition

Most common for membership and subscription orders, and for clients where multi-year orders are common, the ANNIVERSARY recognition method will recognize a full year of the deferred amount, on the start date of the order, and on each anniversary date of the order. It is prorated to determine how much constitutes a full year of value based on the number of months between the start and end dates of the order.

Fiscal Year Method

Like anniversary, the FISCAL YEAR method is most useful when there are multiple year orders, but also when the organizations fiscal year differs from the billing cycle. The fiscal year is set up as a system parameter, and will affect where the stair steps occur in the contour of the recognition amount